GEt in touch

Send us a mail!

Don’t hestitate to get in touch if you have a question or need more information!

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form :(

OPTIMAL TRAVEL

1(888) 450-4950Don’t hestitate to get in touch if you have a question or need more information!

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form :(

OPTIMAL TRAVEL

1(888) 450-4950

Coverage for travellers travelling around the world including USA and travelling out-of-province looking for 24/7 assistance for Travel Medical Emergency coverage.

GET STARTEDCoverage for Healthy and Active Canadians, including Seniors travelling around the world and the USA looking for 24/7 assistance for Travel Medical Emergency coverage.

Part of getting your Work Visa in Canada, it is your responsibility to make sure you have the proper Medical Insurance coverage, while your in Canada. Full insurance coverage up to $300,000 up to 365 days

Canadian Medical Insurance offers a flexible and affordable way to protect against the cost of unexpected Medical Emergencies while in Canada. Full insurance covereage up to $300,000 coverage.

No medical exam needed upon application. Health questions over the phone or online.

Top-up insurance coverage and extensions on any existing plans are available to purchase.

No fee to change travel dates prior to

departure and no extra fee to extension.

Option to enhance coverage for

Pre-existing health conditions

The applicant(s) is over the age of 14 days old and has not reached the age of 100 years at the time of application.

Find the right coverage for the right occasion.

When applying to cover your pre-existing condition(s);

- We strongly recommend that you contact our in-house specialists.

- We will arrange a quick medical assessment

- We will provide best coverage options available with affordable rates.

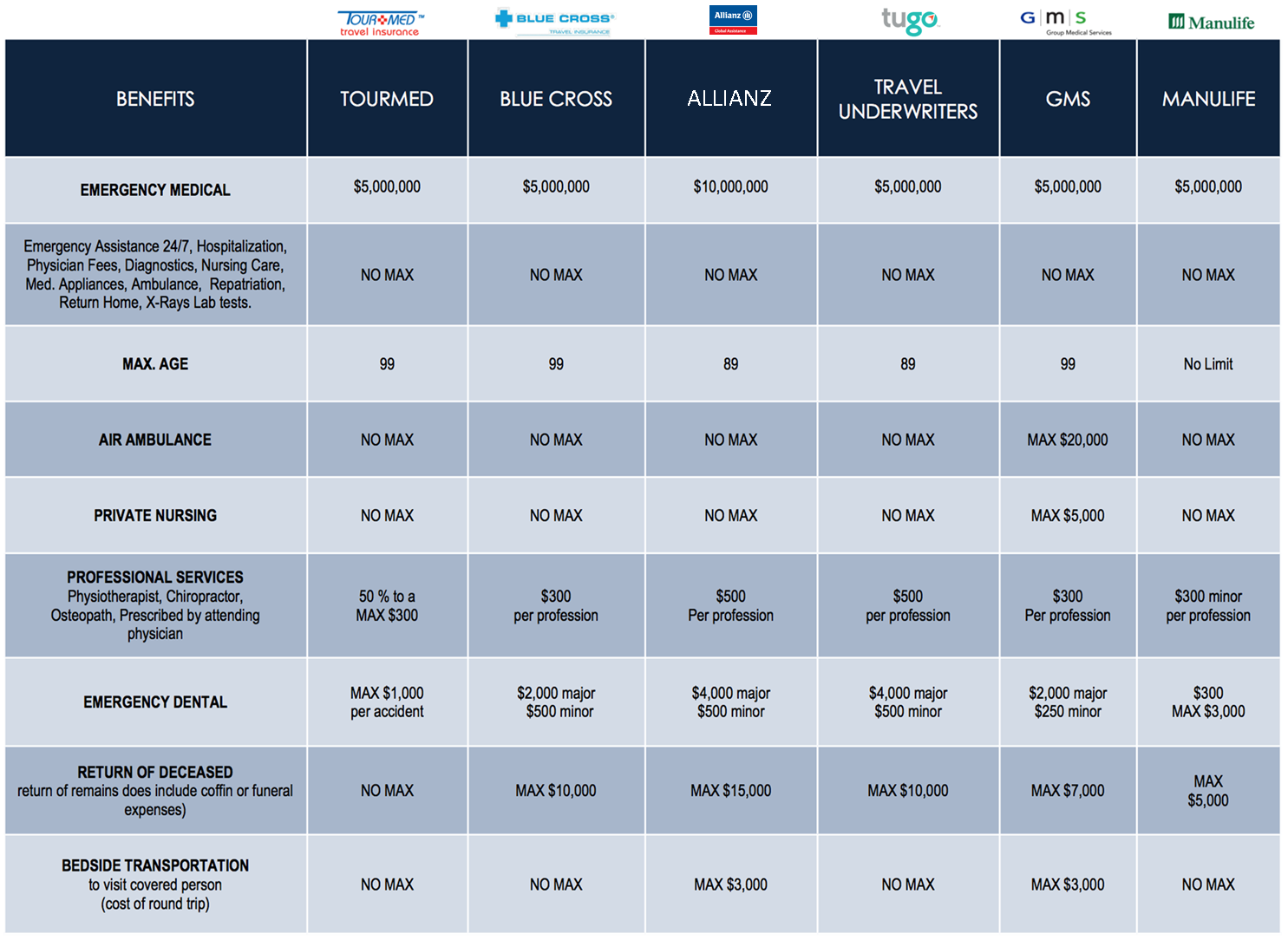

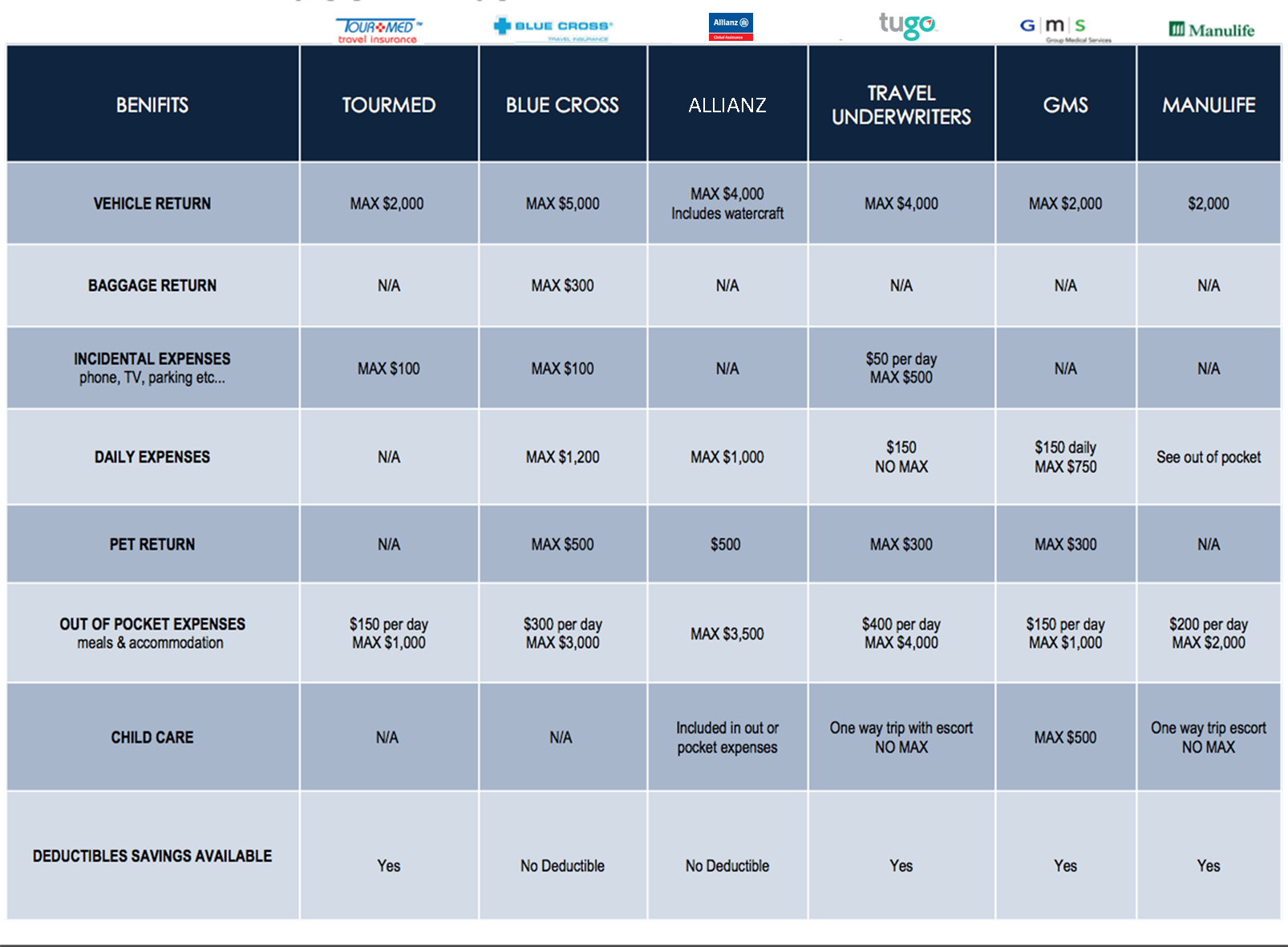

Most Medical Travel Insurance Policies have mostly the same benefits, what differ the most from one insurer to another, are the amounts covered under their plans and their rates.

Some insurers are more competitive on benefits and rates with a certain niche market, that’s why comparing benefits & rates will help you find the best travel insurance plan for you.

On the next tabs, you will find a quick comparaison sheet to able you to better compare the different benefits.

Learn more on which coverage is best for you, contact our

Specialists

!

* RULE OF THUMB *

Best Rates doesn’t Always mean Best Insurance Coverage. Ask Questions!

Although the contents of this Website are deemed reliable when posted, Optimal Travel™ has made every effort to provide accurate and updated information about our providers, but cannot guarantee this information from the provider to be current, accurate or complete. The information is subject to modification and updating from time-to-time without notice.

When you purchase coverage, the proper documents from the insurance company will be provided.

Looking for Money Saving Options? We have great deals for you!

Save up to 75% and even more...Various Discounts & Savings.

Call us to activate these savings 1-888-450-4950

For a single premium at the time of purchase, once a year, you can travel as many times as you wish, anywhere around the world, without having to call us back before each departure. Providing that the duration doesn’t exceed the number of days covered by your plan. If you have longer trips, you can just add those days for that specific trip.

Ask our Experts if you could benefit from an Annual Plan;

Receive up to a 10% discount when 2 people travel together and are insured on the same policy.

Ask our Experts if you could benefit from this discount;

In most cases, it is cheaper to purchase the comprehensive travel insurance package than

purchasing each plan separately like medical and non medical protections simultaneously.

* Including Trip Cancellation & Trip Cancellation.

You can save up to 60% of the cost of individual plans.

Ask our Experts if you could benefit from this discount;

Some our providers will grant our clients a $5 discount per applicant in return.

Ask our Experts if you want to benefit from the Green Rebate;

Official dates vary from one year to another and are subject to change without notice. Discounts are usually available

between the beginning of July and the end of September.

Don’t miss out on them! Inquire early for specials, even if you only have tentative dates.

Ask our Experts if you could benefit from EarlyBird Discounts;

Rule of Thumb: Higher Deductible, equals More Savings!

Only choose a deductible that you can afford. You may save up to 75% in rates.

Learn more about your different deductibles options.

Ask our Experts if you could benefit from Deductibles Discounts;

An All Inclusive Travel Insurance policy is often the best value.

Depending on the policy, not only does it provide the basics like emergency medical but also trip cancellation and trip interruption insurance, accidental death and dismemberment insurance, delayed/lost baggage and more.

Also call Comprehensive Travel Insurance, it combines Medical, Cancellation, Interruption, Baggage and Accidental Death insurance, ALL in one packaged plan.

- Emergency Medical Insurance

- Trip Cancellation Insurance

- Trip Interruption Insurance

- Baggage Insurance

- Accidental Death and Dismemberment ( 'AD&D' )

Ask our Experts if you want to add some of those benefits.

Those coverage extension are taken as an add-on policy with any health insurance policy, with the same or a different insurer.

If you are a holder of an Annual Plan, have group or credit card coverage , convenient Top-Up coverage can be added to extend your trip for durations of up to 212 days depending on your province of residence.

Ask our Experts if you would benefit or qualify for Top-Up Insurance Coverage.

IMPORTANT: Make sure you understand some of the restriction regarding Top-up coverage.

Travel insurance that lasts one year. A Multi trip travel insurance plan is valid for 365 days. It is also referred to an Annual Plan Insurance.

Annual Travel Insurance coverage lets you travel around the world as often as you wish, without having to notify the insurer, provided that your trip duration does not exceed the maximum number of days selected.

Multi-trip coverage is also convenient and flexible. It offers different trip length options for annual multi trip policies.

There’s no need to reapply for each trip, and you can easily upgrade the coverage if more days are needed. Quick out-of-province trips and planned out-of-Canada vacations are both covered and you don’t have to inform us of your travel dates.

Ask our Experts if you would benefit from an Annual Plan.

Sometimes life takes over and your travel plans go out the window. You can’t plan for everything.

There are times when you are forced to call off, change, or even interrupt a well–planned trip.

The investment that you make when booking travel arrangements can be significant:

– If you are forced to cancel your trip, you may have to pay cancellation penalties charged by the airline or the tour operator.

– If you must disrupt your trip and return home prematurely, the costs can be even more severe.

From the date you book your plane ticket, hotel and other travel arrangements, you can purchase your Trip Cancellation/Trip Interruption Insurance. When you purchase Trip Cancellation/Trip Interruption Insurance, your eligible non-refundable, pre-paid travel costs will be covered if you are forced to cancel or interrupt your trip, up to the coverage amount purchased.

Ask our Experts if you would benefit from Trip Cancellation & Interruption Coverage.

You take the time to pack your personal belongings and you expect them to arrive when you do. Unfortunately, sometimes your baggage and belongings arrives damaged, or even worse, not at all.

What do you do?

Rental Car Collision Damage Protection Coverage

Damage and physical loss protection for your rental car.

Golf Protector

Protection and coverage for your golf equipment and prepaid green fees.

Ski Protector

Protection and coverage for your ski and snowboard equipment, and prepaid lift passes.

Business Protector

Protection and coverage for your business equipment. An example would be your laptop computer.

Cruise & Tour Protector

Protection and coverage for your missed pre-booked cruise or tour departure.

Expanded Benefits Upgrade

Additional benefit limits and coverage for emergency medical/dental, trip cancellation, interruption, delay,

luggage and personal effects.

More Benefits are available...

Ask our Experts if you want to add some of those benefits.

Emergency Medical Care

What are the eligibility requirements?

- All individuals under are Canadian residents

- You purchase the plan in your province of residence

- You are not travelling against a physician's advice

- You have not been diagnosed with a terminal condition

Visitor’s to Canada

What are the eligibility requirements?

- You purchase before your arrive in Canada.

- You are not travelling against a physician's advice

- You have not been diagnosed with a terminal condition

- Family & student rates are available

What if you have already departed for your trip? NOT TOO LATE

If you have already left your province of residence or you already left Canada? Or even, you are already in Canada and need to get Medical Insurance? Medical Coverage may still be available. Get the right information before it’s too late!

To inquire about all your options, you will need to contact our in-house Specialist.

For an Early Return, a refund may be requested for the unused days, provided no claims were submitted.